This guest post is contributed by Renisha Chainani, Head - Research, Augmont Goldtech Pvt. Ltd.

Gold has not only maintained its status of "store of value" for over 5,000 years but also preserved its purchasing power. Gold is a highly liquid asset and customers can easily use it to satisfy their liquidity needs. Loans are provided by lenders who secure gold assets as collateral. In India, the gold loan market is big business compared with the rest of the world. India is one of Gold's largest consumers with an estimated cumulative stock approaching 25000 tonnes, of which 65 percent belong to the rural population1. Because of the household jewellerys' emotional value, people rarely sell their gold to meet their immediate financial needs. However, people pledge their ornaments as collateral, as an alternative, and secure short-term loans.

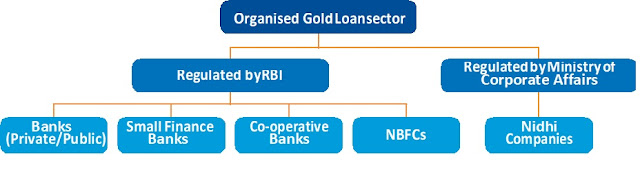

At a broad level, the lenders of gold loans are classified into two main categories: Organised and Unorganised. Because gold loans are granted against the gold pledged by borrowers, the amount of gold available to customers is a key parameter when determining the size of gold loans on the market. For centuries, money lenders and pawnbrokers have provided gold loans to people from all walks of life. Currently, the Unorganized Gold Loan market in India is estimated to be close to 65 percent of the total market for gold loans. Unorganized players provide quick gold loans with little documentation but at a very high-interest rate, with their local market knowledge. Customers are at risk of exploitation by these players because they are totally unregulated.

Until two decades ago, most of the lending was through pawnbrokers and money lenders in the unorganized sector. However, this scenario is changing with the arrival of organized players in the sector, such as banks and non-bank finance companies (NBFCs), which now command over 60 percent of the market. The organized market for gold loans has grown by more than 30 percent between 2010 and 20192.

Outstanding total gold loans in the organized sector in 2019 are estimated at 5.5 percent of India's total household gold holdings, indicating a low market penetration. Gold loan demand is projected to hit new heights, however, with the ease in monetizing gold and enhanced economic development in rural India. In the meantime, the organized market for gold loans comprising banks (public, private, small finance and co-operative), Non-Banking Financial Company (NBFCs) and Nidhi companies contribute to nearly 35 percent of the Indian gold loan market.

Owing to its large network, quicker turnaround time, higher Loan-to-value (LTV) ratios and the opportunity to service non-bankable customers, NBFCs were a big driving force behind this development. The comparative advantage in this industry is that the average tenure in gold loans is at an average of 4-5 months3, which means strong receivables for them. Even under these economic slowdown conditions, they can manage their growth cycle with dynamic quantitative management by lowering the LTV and loan advances.

Gold Loan Industry Phases

Phase 1 (2006-2011) – High growth4

• The Branch network grew 7x.

• Higher LTV up to 85%.

• Gold prices rose 150% in five years.

• Lower cost of funds because of eligibility under priority sector lending.

• Rise of India’s middle class, consumerism and urbanization

• Support from buoyant economic growth.

Phase 2 (2012-2013) – Regulatory tightening

• RBI removed the priority sector tag from the sector in March 2012, which led to higher borrowing costs.

• RBI capped LTV to 60% in March 2012, which weakened competitive positioning.

• Higher LTV-focused customers moved to moneylenders, whereas interest-sensitive customers moved to banks.

• Gold prices fell 25% in two years.

• RBI prohibited the grant of loans against bullion/primary gold and gold coins.

• RBI prohibited the inclusion of making changes in the value of the jewellery.

• RBI placed a limit on banks’ exposure to a single gold NBFC to 7.5% from 10.0% earlier.

Phase 3 (2014-2015) – Regulatory easing and Growth

• Tier I capital requirement was increased to 12% in April 2014

• RBI increased the cap on LTV to 75% in September 2013.

• RBI capped banks’ LTV also to 75%, thereby creating a level playing field.

• Stability in gold prices since then.

• Introduction of non-gold products by gold loan NBFCs.

• Operating leverage kicking in.

• Key players started leveraging technology (online gold loan), personalized loan schemes, improved branding and targeted marketing

Phase 4 (2016-2017) – Demonetization hiccups

• Demonetization and GST related hiccups

• A transitory slowdown in the gold loan business

• Higher delinquencies and write-off in microfinance business

• Cash crunch in the market led to an immediate shortfall in business

• Weakness in the rural economy

Phase 5 (2018-2019) – NBFC Liquidity Stress5

• The NBFC liquidity stress led to a slowdown in disbursals among small players as they were fund starved

• The cost of funds for large gold loan players and banks remained relatively stable but increased for smaller players

• The prevailing liquidity crunch in India means that the demand for gold loans remains strong as consumers are looking to meet their short-term fund requirements

• The emergence of new-age fintech and online gold loan companies is transforming the way traditional way of doing the gold loan business to a highly digitised model.

Phase 6 (2020-2021) – COVID-19 pandemic doubles the AUM

• Gold prices rose 15% in 2020 and 2021, due to safe-haven buying amid COVID-19 fears.

• Gold loan business shines as economic stress grows amid the pandemic. Fears of recession, Liquidity crisis, Nationwide Lockdown, Travel Restriction, Work from Home or Layoffs for employees lead to companies operating with 50% staff.

• Early in August 2020, the RBI announced an increase in the loan-to-value ratio on gold loans given by banks (from 75 percent to 90 percent) up to March 31, 2021, to provide relief to borrowers affected by the pandemic.

• Gold loans business AUM doubles and perform better than other credit products amid people seeking refuge in a slowdown, rising gold prices, the risk profiles of borrowers deteriorating and lenders becoming risk-averse.

1 Retrieved from https://bfsi.economictimes.indiatimes.com/news/nbfc/nbfc-crisis-didnt-bother-us-muthoot-finance/69967990

2 Retrieved from https://www.moneycontrol.com/news/business/markets/the-glittering-nbfc-gold-loan-sector-promising-future-4480421.html

3 Retrieved from https://bfsi.economictimes.indiatimes.com/news/nbfc/nbfc-crisis-didnt-bother-us-muthoot-finance/69967990

4 Retrieved from http://www.idbidirect.in/IDBIAdmin/Pdf/Gold%20Finance_Sector%20Report_270318_Retail-27-March-2018-1319447120.pdf

5 Retrieved from https://assets.kpmg/content/dam/kpmg/in/pdf/2020/01/return-of-gold-financiers-in-organised-lending-market.pdf

Author Bio:

• Renisha Chainani has rich research experience of over 15 years and expertise in Fundamental, Technical, Sentimental, and Intermarket Analysis in Bullion, Commodities, and FOREX.

• Before joining Augmont, she was associated with IIMA-IGPC and was heading the Commodities research desk at India’s top broking companies like Edelweiss Securities, Globe Capital, and Monarch Networth Capital Ltd.

• She holds an MBA(Finance) degree and is currently pursuing a Ph.D. in Gold Markets from Gujarat University.

• Mrs. Chainani has published various research papers in renowned international journals and her articles in print media.

• She has been a prominent guest speaker on business news TV channels like CNBC TV 18, CNBC Awaaz, Zee Business, ET Now, etc for the last 8 years to share her views on Bullion and Commodities Markets

[Disclaimer: This is a Sponsored Post.]