Unlike an equity mutual fund that invests in the stock markets, a debt mutual fund invests in fixed-income securities such as Bonds, Debentures, Govt. Securities, Commercial Paper, Treasury Bills, Certificate of Deposits, etc. Therefore, it is comparatively speaking, a much 'safer' option than an equity fund.

However, 'safe' is rather a relative term. It doesn't mean that debt mutual funds have 'zero' risk.

Having said that, even if the risk is not zero, it is definitely quite LOW. Plus, you pay much LOWER TAX on the earnings than the conventional fixed-income products such as Bank FDs, Post Office schemes, etc. And, it offers other benefits too.

Therefore, if you choose your debt funds with care and diversify your investment across different categories and AMCs, you will definitely be much better of as compared to putting your money in the Bank FDs, etc.

By the way, debt funds are a lot safer than Co-operative Banks and Corporate Deposits, where you often invest your money to earn that extra 1-3% interest. Lots more people have lost their ENTIRE money in Co-operative Banks and Corporate Deposits vis-a-vis a few occasional MINOR losses in the debt mutual funds.

So, don't let this 'little' risk scare you into not investing in such an excellent investment option.

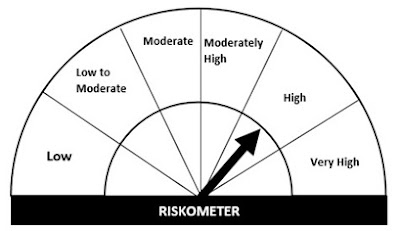

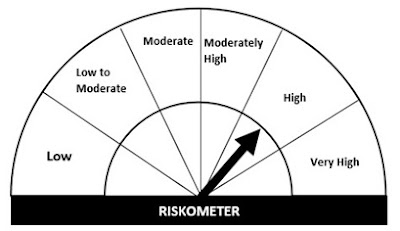

And, to make your job easier in choosing the most appropriate funds for your risk appetite, SEBI has introduced new guidelines 'Product Labeling in Mutual Fund schemes – Risk-o-Meter'. As per the same, the AMCs will have to first calculate the Risk Value of each debt scheme and then reflect the appropriate risk level by way a Risk-o-meter.

Even though the concept of Risk-o-meter is not new, there is a BIG CHANGE in how the risk level will be assigned to a particular scheme.

Earlier, for example, all credit risk funds were classified as having 'moderate risk'. However, as practical experience has shown, some credit funds had significant investment in low-rated illiquid securities, while some were invested mainly in the high-rated securities. So, logically, the first credit risk fund was far riskier than the second credit risk fund.

Such kind of problems have been addressed in the new SEBI guidelines. The AMCs will henceforth have to follow an elaborate process to calculate the actual risk in EACH scheme separately and assign a Value. And based on this Risk Value of the scheme, the level of risk will be depicted on the Risk-o-meter.

The Risk-o-meter will have six levels, viz.

- Low

- Low to Moderate

- Moderate

- Moderately High

- High

- Very High

Let's explore:

For simplicity sake, I will just highlight the concept and keep out the (messy) details. Those interested in the nitty gritty can refer to the SEBI Circular No.: SEBI/HO/IMD/DF3/CIR/P/2020/197 dated Oct 05, 2020.

There are typically three types of risks in a debt fund.

1. Credit Risk

This is the risk of default. If the company, where the scheme has invested a part of its corpus, doesn't pay the interest or repay the capital, it is a loss to the scheme. Consequently, the NAV will come down and your returns will accordingly be impacted.

SEBI has given a Credit Risk Value of 1 to Govt. Securities and AAA-rated investments; Credit Risk Value of 2 to AA+ investments; and so on up to Credit Risk Value of 12 to Below-investment-grade rated investments.

So, based on the weighted average value of each investment in the portfolio, Credit Risk Value of the total portfolio will be calculated.

For example, if all the securities in the portfolio are AAA, the Credit Risk Value of the scheme will be 1. And, if all the securities are below investment grade, the scheme will have a Credit Risk Value of 12.

In other words, the lower the Credit Risk Value of the scheme, the lower is the risk of default.

2. Interest Rate Risk

As you may be aware, if the market interest rates go up, NAVs fall. And, if the interest rates go down, NAVs go up. So the NAV of a debt fund has an inverse relation to how the interest rates move in the market.

Further, the longer the tenure of the bond/security, the more is the impact on NAV. So, funds with shorter tenure investments in the portfolio will be less affected by the interest rate movements.

SEBI has given an Interest Rate Risk Value of 1 if the (Macaulay) Duration of the portfolio is less than equal to 0.5 years; Interest Rate Risk Value of 2 if the (Macaulay) Duration of the portfolio is more than 0.5 years but less than equal to 1 year. And so on, going up to Interest Rate Risk Value of 6 if the (Macaulay) Duration of the portfolio is more than 4 years.

In other words, the lower the Interest Rate Risk Value of the scheme, the lower is the risk of interest rate movement.

[Important: If you feel that market interest rates are near bottom and likely to go up in the future, it is best to invest in schemes with shorter tenure. But, if the interest rates are at near peak and likely to reduce in the future, it is best to invest in schemes with longer tenure. Capital appreciation in bond prices will give a significant boost to the NAVs. Read 'You Can Lose Money Even In The Govt. Securities' for more clarity on this interesting aspect.]

3. Liquidity Risk

If the mutual fund scheme can quickly sell its investments and without any loss, to meet any redemption request, it is considered as low liquidity risk. But if the investments in the scheme are difficult to sell or to be sold at a huge discount, the MF investor suffers higher liquidity risk.

SEBI has given a Liquidity Risk Value of 1 to Govt. Securities and AAA-rated PSUs; Liquidity Risk Value of 2 to AAA-rated investments; and so on up to Liquidity Risk Value of 14 to Below investment grade and unrated investments.

So, based on the weighted average value of each investment in the portfolio, the Liquidity Risk Value of the total portfolio will be calculated.

The overall Risk Value of the debt fund would then calculated by taking a simple average of Credit Risk Value, Interest Rate Risk Value, and Liquidity Risk Value. [Note: If the Liquidity Risk Value is higher than this average, then Liquidity Risk Value will be taken as the scheme's Risk Value and not the average.]

This Risk Value will then be mapped on the Risk-o-meter as under:

- Low: <= 1

- Low to Moderate: >1 to <=2

- Moderate: >2 to <=3

- Moderately High: >3 to <=4

- High: >4 to <=5

- Very High: >5

The Risk-o-meter of each scheme will be updated every month, based on the changes in the portfolio during the month. Any major change in the risk level will be communicated to the existing unitholders.

These guidelines will become effective from Jan 1, 2021.

CAUTION: The idea is good. However, mapping an average figure onto a Risk-o-meter will not adequately serve the purpose. Ideally, all three Risk Values i.e. Credit Risk Value, Interest Rate Risk Value, and Liquidity Risk Value should be displayed along with the scheme details.

Also, please note that Risk is just one of the various parameters that need to be evaluated before making any investment. Merely relying on the Risk-o-meter is not enough.