The Reserve Bank of India, has vide its notification Real Time Gross Settlement (RTGS) System – Extension of Timings for Customer Transactions dated May 28, 2019, has extended the RTGS timings.

The extended timings for customer transactions (initial cut-off) in RTGS will be 6:00 pm as against 4:30 pm at present.

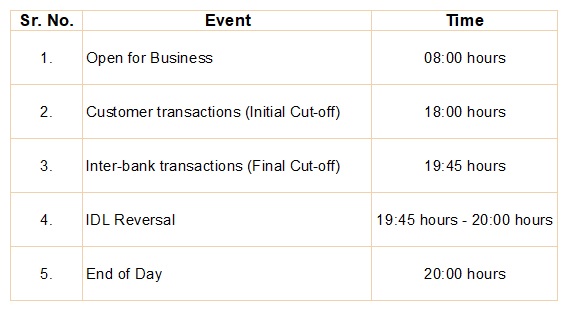

Accordingly, the revised RTGS timings will be as under:

RTGS or Real Time Gross Settlement is a commonly used system for online funds transfer for high-value transactions. The minimum amount that can be transferred under RTGS is Rs.2 lakhs. There is no maximum limit.

The time-varying charges for transactions in RTGS from 13:00 hours to 18:00 hours shall be Rs.5 per outward transaction.

The revised time varying charges structure is as under:

The new RTGS timings will be effective from June 1, 2019.

RBI has fixed the maximum charges that the banks can levy their customers, if they so desire, for RTGS transfers. These are as under:

a. Inward transactions - Free

b. Outward transactions

Rs.2 lakh to Rs.5 lakh - Rs.25 + applicable time varying charge, subject to a max of Rs.30/-.

Above Rs.5 lakh - Rs.50 + applicable time varying charge, subject to a max of Rs.55/-.

The extended timings for customer transactions (initial cut-off) in RTGS will be 6:00 pm as against 4:30 pm at present.

Accordingly, the revised RTGS timings will be as under:

RTGS or Real Time Gross Settlement is a commonly used system for online funds transfer for high-value transactions. The minimum amount that can be transferred under RTGS is Rs.2 lakhs. There is no maximum limit.

The time-varying charges for transactions in RTGS from 13:00 hours to 18:00 hours shall be Rs.5 per outward transaction.

The revised time varying charges structure is as under:

The new RTGS timings will be effective from June 1, 2019.

RBI has fixed the maximum charges that the banks can levy their customers, if they so desire, for RTGS transfers. These are as under:

a. Inward transactions - Free

b. Outward transactions

Rs.2 lakh to Rs.5 lakh - Rs.25 + applicable time varying charge, subject to a max of Rs.30/-.

Above Rs.5 lakh - Rs.50 + applicable time varying charge, subject to a max of Rs.55/-.