Systematic investment plans (SIPs) have emerged as a powerful and popular tool for investors to meet their financial goals.

There are, however, times when some financial goals seem difficult to achieve within the required horizon due to paucity of funds.

For instance, Rs.20,000 invested per month at a growth rate of 12% p.a. could give an investor a corpus of Rs.2 crores at the end of 20 years; but what if the investor does not have the required funds to invest?

Most investors would either reduce the goal amount or increase their investment horizon to achieve the goal. The good news is that investors don't need to compromise. Instead, they can use another available feature — SIP top-up — to meet their desired goals systematically.

What is SIP top-up and how does it help?

The SIP top-up feature helps investors increase their installments by a fixed amount at pre-determined intervals and, thus, leverage the rise in income. Mutual funds offer the facility to automatically increase SIP amount in multiples of Rs 500 quarterly, half-yearly and annually.

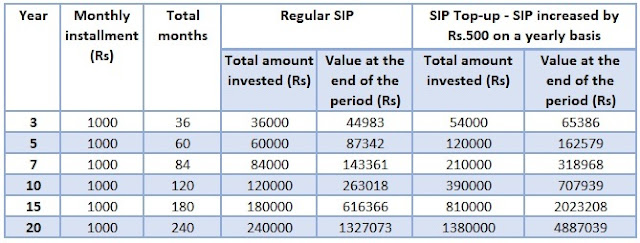

The following illustration shows how SIP top-up is different from regular SIP.

CASE STUDY

Investors A and B started SIP: A invested Rs 1,000 via SIP in an equity mutual fund for 20 years with an annualised growth rate of 15%*. B decided to top up the same monthly investment with only Rs.500 per month on a yearly basis.

(* Average of annualised 15years’ rolling returns of S&P BSE Sensex since 1979)

As seen in the next table, investor A's investment of Rs.2.40 lakh grew to Rs.13 lakhs, while B's investment of Rs.13.80 lakhs shot up to nearly Rs.49 lakh in 20 years.

Result – With a small increase in SIP installment, wealth multiples at a faster pace for investor B than for investor A.

SIP top-up can help investors attain their goals faster than regular SIP thanks to the power of compounding.

The top-up facility also helps investors who do not have enough current surplus to achieve the same goals over a targeted period.

Let's take the earlier example — an investor does not have Rs.20,000 to reach his / her goal of Rs.2 crore in 20 years. This goal can be achieved by starting a SIP investment of Rs.10,000 and topping it up by 10% every year to meet the goal within the stipulated timeline.

Benefits of SIP top-up

Start a SIP and don't forget to supplement it as income appreciates to quickly reach your financial goals.

Disclaimer - CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/ transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division / CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division / CRIS. No part of this Report may be published / reproduced in any form without CRISIL’s prior written approval.

There are, however, times when some financial goals seem difficult to achieve within the required horizon due to paucity of funds.

For instance, Rs.20,000 invested per month at a growth rate of 12% p.a. could give an investor a corpus of Rs.2 crores at the end of 20 years; but what if the investor does not have the required funds to invest?

Most investors would either reduce the goal amount or increase their investment horizon to achieve the goal. The good news is that investors don't need to compromise. Instead, they can use another available feature — SIP top-up — to meet their desired goals systematically.

What is SIP top-up and how does it help?

The SIP top-up feature helps investors increase their installments by a fixed amount at pre-determined intervals and, thus, leverage the rise in income. Mutual funds offer the facility to automatically increase SIP amount in multiples of Rs 500 quarterly, half-yearly and annually.

The following illustration shows how SIP top-up is different from regular SIP.

CASE STUDY

Investors A and B started SIP: A invested Rs 1,000 via SIP in an equity mutual fund for 20 years with an annualised growth rate of 15%*. B decided to top up the same monthly investment with only Rs.500 per month on a yearly basis.

(* Average of annualised 15years’ rolling returns of S&P BSE Sensex since 1979)

As seen in the next table, investor A's investment of Rs.2.40 lakh grew to Rs.13 lakhs, while B's investment of Rs.13.80 lakhs shot up to nearly Rs.49 lakh in 20 years.

Result – With a small increase in SIP installment, wealth multiples at a faster pace for investor B than for investor A.

SIP top-up can help investors attain their goals faster than regular SIP thanks to the power of compounding.

The top-up facility also helps investors who do not have enough current surplus to achieve the same goals over a targeted period.

Let's take the earlier example — an investor does not have Rs.20,000 to reach his / her goal of Rs.2 crore in 20 years. This goal can be achieved by starting a SIP investment of Rs.10,000 and topping it up by 10% every year to meet the goal within the stipulated timeline.

Benefits of SIP top-up

Start a SIP and don't forget to supplement it as income appreciates to quickly reach your financial goals.

Disclaimer - CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/ transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division / CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division / CRIS. No part of this Report may be published / reproduced in any form without CRISIL’s prior written approval.