Compounding has made many millionaires.

But very rarely do they get written about. Nobody is interested in the dull, monotonous and tedious stories.

Fun, excitement, drama... that’s what people like, and demand. Hence the media too seldom focuses its attention on those who made their millions in a simple and straightforward manner.

You should, however, not forget that your objective here is to make millions, not fun and drama. There are many other avenues to get your dose of fun and drama. Therefore, as far as making money is concerned, stick to the time-tested rules.

As explained in my earlier blog post 'Compound Your Way to Wealth', the formula is plain and obvious. Even the genius like Albert Einstein was a great admirer and supporter of the method of compounding.

The problem is not so much in understanding it — but in implementing it.

Well, that’s because it's rather time-consuming. Therefore, in today's fast-paced world — where things work at the touch of the button — I guess it is impractical to expect people to be patient. No one wants to sow the seeds; and then wait for years for them to bear the fruits. They would rather sit at home and hope to win a lottery or hit a jackpot.

Yes, I agree that the compounding process does test one's patience and commitment.

However, let me also assure you that it is only the beginning that's difficult:

You know how it is with a car. When you start, it takes some time to overcome inertia and pick up speed. But thereafter the acceleration is much faster. Remember the good old Newton’s law you studied in your school?

Same principle applies to your wealth creation too... once it picks up momentum, it becomes easier and easier and easier... and you become richer and richer and richer.

Want to see how it works?

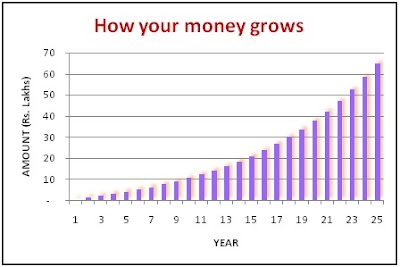

Suppose you invest Rs.5000 every month for 25 years. Thus, you would have invested Rs.15 lakhs. Assuming 10% p.a. returns, you will have about Rs.65 lakhs at the end. Let us see graphically how this money growth looks like.

This is fine.

But the more important point to note here is how your wealth accelerates.

See the graph below:

As you can see,

- It takes 10 long years to reach to your first Rs.10 lakhs.

- But the next Rs.10 lakhs (i.e. from Rs.10 to 20 lakhs) takes just 5 years to accrue

- The next from Rs.20 to 30 lakhs in 3 years

- (and so on) From Rs.50 to 60 lakhs in merely 1.75 years.

The analogy of boiling water might be quite apt here. What happens when you start to boil water? To begin with, its temperature starts rising... from 25oC to 30oC to 50oC and so on. Though the water is getting hotter, nothing noticeable is happening on the surface… right up to 99.9oC. And then, with increase in temperature by just 0.1oC, the water starts boiling.

If you didn't have the knowledge and patience, you would have stopped heating in between — exclaiming that nothing seems to be happening. This way you would never get your boiling water!

Even if you take a temporary break, you may have to start all over again. So, once you begin, never stop in-between.

In short, you will realize your millionaire dreams, provided

a. You don’t stop your regular contributions to the portfolio

and

b. You are willing to be patient.

At some point your portfolio will reach the critical mass. And then, like a nuclear explosion, you will experience wealth explosion. [By the way, now you will experience the fun and drama too... which was earlier missing.]

That's what I said earlier. You have to be patient in the initial years. But later the growth will be exponential. Thus you will achieve your financial independence much sooner than what may initially appear to be a long and interminably wait.

This is the magic of compounding.

But very rarely do they get written about. Nobody is interested in the dull, monotonous and tedious stories.

Fun, excitement, drama... that’s what people like, and demand. Hence the media too seldom focuses its attention on those who made their millions in a simple and straightforward manner.

You should, however, not forget that your objective here is to make millions, not fun and drama. There are many other avenues to get your dose of fun and drama. Therefore, as far as making money is concerned, stick to the time-tested rules.

As explained in my earlier blog post 'Compound Your Way to Wealth', the formula is plain and obvious. Even the genius like Albert Einstein was a great admirer and supporter of the method of compounding.

The problem is not so much in understanding it — but in implementing it.

Well, that’s because it's rather time-consuming. Therefore, in today's fast-paced world — where things work at the touch of the button — I guess it is impractical to expect people to be patient. No one wants to sow the seeds; and then wait for years for them to bear the fruits. They would rather sit at home and hope to win a lottery or hit a jackpot.

Yes, I agree that the compounding process does test one's patience and commitment.

However, let me also assure you that it is only the beginning that's difficult:

You know how it is with a car. When you start, it takes some time to overcome inertia and pick up speed. But thereafter the acceleration is much faster. Remember the good old Newton’s law you studied in your school?

Same principle applies to your wealth creation too... once it picks up momentum, it becomes easier and easier and easier... and you become richer and richer and richer.

Want to see how it works?

Suppose you invest Rs.5000 every month for 25 years. Thus, you would have invested Rs.15 lakhs. Assuming 10% p.a. returns, you will have about Rs.65 lakhs at the end. Let us see graphically how this money growth looks like.

This is fine.

But the more important point to note here is how your wealth accelerates.

See the graph below:

As you can see,

- It takes 10 long years to reach to your first Rs.10 lakhs.

- But the next Rs.10 lakhs (i.e. from Rs.10 to 20 lakhs) takes just 5 years to accrue

- The next from Rs.20 to 30 lakhs in 3 years

- (and so on) From Rs.50 to 60 lakhs in merely 1.75 years.

The analogy of boiling water might be quite apt here. What happens when you start to boil water? To begin with, its temperature starts rising... from 25oC to 30oC to 50oC and so on. Though the water is getting hotter, nothing noticeable is happening on the surface… right up to 99.9oC. And then, with increase in temperature by just 0.1oC, the water starts boiling.

If you didn't have the knowledge and patience, you would have stopped heating in between — exclaiming that nothing seems to be happening. This way you would never get your boiling water!

Even if you take a temporary break, you may have to start all over again. So, once you begin, never stop in-between.

In short, you will realize your millionaire dreams, provided

a. You don’t stop your regular contributions to the portfolio

and

b. You are willing to be patient.

At some point your portfolio will reach the critical mass. And then, like a nuclear explosion, you will experience wealth explosion. [By the way, now you will experience the fun and drama too... which was earlier missing.]

That's what I said earlier. You have to be patient in the initial years. But later the growth will be exponential. Thus you will achieve your financial independence much sooner than what may initially appear to be a long and interminably wait.

This is the magic of compounding.