Bank Fixed Deposits...

... offer interest income, which is known beforehand at the time of investment;

... the risk of losing capital is practically nil;

... you can withdraw your investment anytime you wish to (with some loss of interest and penalty);

... there is tedious TDS to deal with.

Debt Mutual Funds...

... offer market-linked returns (which are more or less the same as FD interest);

... the risk of losing capital is (again) practically nil;

... you can withdraw your investment anytime you wish to (with NO interest loss and NO penalty);

... the tedious TDS is completely absent.

This gives a definite edge to the Debt Mutual Funds vis-a-vis the Fixed Deposits.

However, the pre-decided assured returns and the perceived safety of banks, gives a feeling of guarantee and assurance to many investors. So they generally prefer Bank Fixed Deposits and ignore the Debt Mutual Funds.

Beware!

This feeling of safety comes at a (great) price:

While the basic "pre-tax" returns in both cases would be around the same, it is the "post-tax" yield that puts LOT MORE money into your pocket.

In other words, everything — basic returns, safety, liquidity and investment time-frame — remains the same. But, with Debt Mutual Funds you can save HUGE taxes, as compared to Bank Fixed Deposits.

Let's explore with an example:

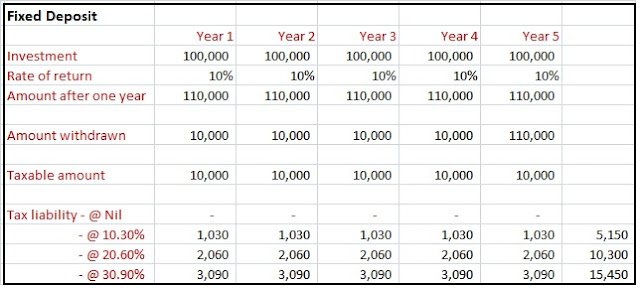

Amount available for investment : Rs.1 lakh

Interest Rate / Mutual Fund Returns : 10% p.a.

Tenure of investment : 5 years

The tax payable, under various income tax slabs, is detailed below.

As you will note, the total tax payable on interest income, over the 5 years of investment, is as under:

- Nil Tax Bracket: Nil

- 10% Tax Bracket: Rs.5150

- 20% Tax Bracket: Rs.10,300

- 30% Tax Bracket: Rs.15,450

a. Dividend is taxed at 28.84%, whatever may be your tax slab. So FORGET about dividends. Never opt for Dividend Option. [Read: All Dividends Taxed Through The Dividend Distribution Tax]

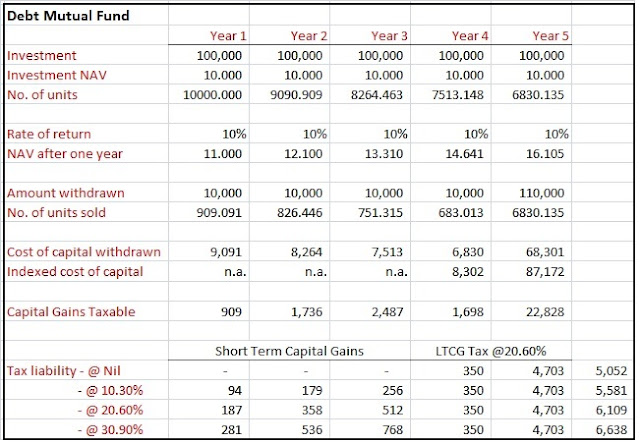

b. Capital Gains for the first THREE years (known as Short Term Capital Gains) are added to your taxable income. Thus, like interest, short term capital gains too are fully taxable as per your income tax slab rate.

Important: However, there is one difference. The amount received is part principal and part gains. Only the gains portion is taxed. Principal portion is not taxed.

c. Capital Gains after THREE years (known as Long Term Capital Gains) are taxed @20% with indexation benefit.

Important: Indexation, which is linked to inflation, increases the effective cost of capital invested. As such the "taxable capital gains" is much lower than the "actual capital gains". Depending on the rate of inflation, this significantly reduces the effective tax rate from 20% to generally around 10% or even lower (sometimes even negative, during periods of high inflation).

Accordingly, the tax payable under various income tax slabs — assuming 5% p.a. inflation — is detailed below.

As you will note, the total tax payable, over the 5 years of investment, is as under:

- Nil Tax Bracket: Rs.5052

- 10% Tax Bracket: Rs.5581

- 20% Tax Bracket: Rs.6109

- 30% Tax Bracket: Rs.6638

(Note: Surcharge as applicable has not been considered in the above calculations.)

Thus, you will observe that

1. Investors in the Nil tax bracket are better off investing in Bank Fixed Deposits

2. By investing in the Debt Mutual Funds, investors in the 20% slab will save about 40% tax, while those in 30% tax bracket will save about 57% tax (at 5% inflation rate). If the inflation is more than 5%, the tax savings is also more. Likewise, if inflation is less than 5%, the tax savings too will be less.

3. At 5% inflation, investors in the 10% tax bracket are more or less neutral to FDs and MFs. If the inflation is more than 5%, they will benefit with Debt Mutual Funds. If the inflation is less than 5%, they will be better off with Bank Fixed Deposits. So they are in a dilemma. If they are willing to bet on high inflation, they should invest in Debt Mutual Funds. But, if they believe that inflation will be low, they should invest in Bank Fixed Deposits.

... offer interest income, which is known beforehand at the time of investment;

... the risk of losing capital is practically nil;

... you can withdraw your investment anytime you wish to (with some loss of interest and penalty);

... there is tedious TDS to deal with.

Debt Mutual Funds...

... offer market-linked returns (which are more or less the same as FD interest);

... the risk of losing capital is (again) practically nil;

... you can withdraw your investment anytime you wish to (with NO interest loss and NO penalty);

... the tedious TDS is completely absent.

This gives a definite edge to the Debt Mutual Funds vis-a-vis the Fixed Deposits.

However, the pre-decided assured returns and the perceived safety of banks, gives a feeling of guarantee and assurance to many investors. So they generally prefer Bank Fixed Deposits and ignore the Debt Mutual Funds.

Beware!

This feeling of safety comes at a (great) price:

While the basic "pre-tax" returns in both cases would be around the same, it is the "post-tax" yield that puts LOT MORE money into your pocket.

In other words, everything — basic returns, safety, liquidity and investment time-frame — remains the same. But, with Debt Mutual Funds you can save HUGE taxes, as compared to Bank Fixed Deposits.

|

| Fixed Deposit or Debt Mutual Fund : Who's the Winner? |

Let's explore with an example:

Amount available for investment : Rs.1 lakh

Interest Rate / Mutual Fund Returns : 10% p.a.

Tenure of investment : 5 years

Option 1: Bank Fixed Deposits

As you are aware, every single rupee of interest income is added to your taxable income. Thus, it is fully taxable as per your income tax slab rate.The tax payable, under various income tax slabs, is detailed below.

As you will note, the total tax payable on interest income, over the 5 years of investment, is as under:

- Nil Tax Bracket: Nil

- 10% Tax Bracket: Rs.5150

- 20% Tax Bracket: Rs.10,300

- 30% Tax Bracket: Rs.15,450

Option 2: Debt Mutual Fund

There are three aspects to taxation on debt mutual funds.a. Dividend is taxed at 28.84%, whatever may be your tax slab. So FORGET about dividends. Never opt for Dividend Option. [Read: All Dividends Taxed Through The Dividend Distribution Tax]

b. Capital Gains for the first THREE years (known as Short Term Capital Gains) are added to your taxable income. Thus, like interest, short term capital gains too are fully taxable as per your income tax slab rate.

Important: However, there is one difference. The amount received is part principal and part gains. Only the gains portion is taxed. Principal portion is not taxed.

c. Capital Gains after THREE years (known as Long Term Capital Gains) are taxed @20% with indexation benefit.

Important: Indexation, which is linked to inflation, increases the effective cost of capital invested. As such the "taxable capital gains" is much lower than the "actual capital gains". Depending on the rate of inflation, this significantly reduces the effective tax rate from 20% to generally around 10% or even lower (sometimes even negative, during periods of high inflation).

Accordingly, the tax payable under various income tax slabs — assuming 5% p.a. inflation — is detailed below.

As you will note, the total tax payable, over the 5 years of investment, is as under:

- Nil Tax Bracket: Rs.5052

- 10% Tax Bracket: Rs.5581

- 20% Tax Bracket: Rs.6109

- 30% Tax Bracket: Rs.6638

(Note: Surcharge as applicable has not been considered in the above calculations.)

Thus, you will observe that

1. Investors in the Nil tax bracket are better off investing in Bank Fixed Deposits

2. By investing in the Debt Mutual Funds, investors in the 20% slab will save about 40% tax, while those in 30% tax bracket will save about 57% tax (at 5% inflation rate). If the inflation is more than 5%, the tax savings is also more. Likewise, if inflation is less than 5%, the tax savings too will be less.

3. At 5% inflation, investors in the 10% tax bracket are more or less neutral to FDs and MFs. If the inflation is more than 5%, they will benefit with Debt Mutual Funds. If the inflation is less than 5%, they will be better off with Bank Fixed Deposits. So they are in a dilemma. If they are willing to bet on high inflation, they should invest in Debt Mutual Funds. But, if they believe that inflation will be low, they should invest in Bank Fixed Deposits.