Our past experience tells us that the details of Tax Deducted at Source (TDS) are the most cumbersome and troublesome aspect of this process.

As you know, TDS is deducted by your employer, your banker, your tenant and now even the buyer of your property. All these, and such other tax deductions, are consolidated at a single point which goes by the name... Form 26AS.

Income Tax Department has mandated that you must ensure that all your TDS deductions have been correctly captured in this Form 26AS.

There can be many reasons for a discrepancy. For example, the bank may have entered incorrect PAN No. and so the TDS it has deducted will not feature in your Form 26AS. Or, the TDS has been deducted but not actually deposited with the Govt. by the tax deductor.

If there are such instances, where you claim any TDS payment which is not reflecting in Form 26AS, the same would be disallowed by the Income Tax Department. Therefore, it is imperative that you verify Form 26AS for TDS deductions and get the anomalies sorted out, before you file your IT Return.

This, as you will experience yourself, is an extremely simple affair.

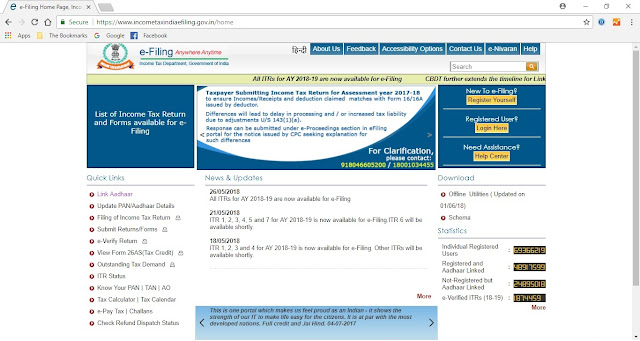

Step 1: Go to Income Tax Department's e-filing website https://www.incometaxindiaefiling.gov.in/home

Step 2: (In case haven't done so till now) Register yourself. It will take only a couple of minutes.

Step 3: Once you are registered, log into the website by entering your ID (which is nothing but your PAN No.), Password and Date of Birth

Step 4: Under 'My Account' click on the 'View Form 26AS' link

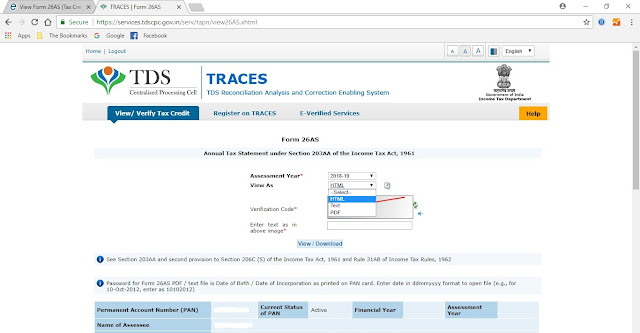

Step 5: Click Confirm for 'You will be redirected to the TDS-CPC website to view Form 26AS (Tax Credit Statement)' This will take you to the TRACES website.

Step 6: Click on the 'View Tax Credit (Form 26AS)' link

Step 7: Choose the relevant Assessment Year e.g. 2018-19

Step 8: View / Download in the format (HTML / Text / PDF) that you prefer

Step 9: Log out from both the websites i.e. TRACES and E-Filing

In fact, instead of waiting till the year-end, you should ideally check your Form 26AS regularly after every 3-4 months. This will ensure that you get enough time to sort the errors, if any, with the tax deductors.

By the way, your Form 26AS contains not only the details of TDS but also those pertaining to the refunds, high value transactions and much more.