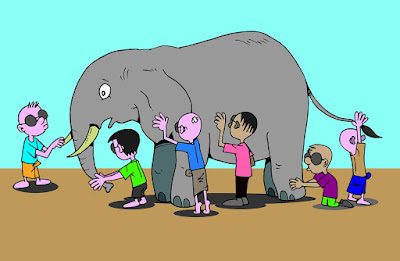

You would have surely read the fable 'Six blind men and the elephant' in your childhood.

In this article I apply the same principle to investing in mutual funds.

The first man touched the elephant's body. It felt hard, big and wide. 'An elephant is like a wall' he said.

The second man touched one of the elephant's tusks. It felt smooth and hard and sharp. 'An elephant is like a spear' he said.

The third man touched the elephant's trunk. It felt long and thin and wiggly. 'An elephant is like a snake' he said.

The fourth man touched on of the legs. It felt thick and rough and hard and round. 'An elephant is like a tree' he said.

The fifth man touched one of the elephant's ears. It felt thin and it moved. 'An elephant is like a fan' he said.

The sixth man touched the elephant's tail. It felt long and thin and strong. 'An elephant is like a rope' he said.

The men argued. It's like a wall! No, it isn't! It's like a spear! No it isn't! It's like a snake! They did not agree. The king had been watching and listening to the men. 'You are not very clever. You only touched part of the elephant. You did not feel the whole animal. An elephant is not like a wall or a spear or a snake, or a tree or a fan or a rope'.

The men left the town still arguing.

(Story courtesy https://www.teachingenglish.org.uk/article/six-blind-men-elephant.)

The first man bought a debt mutual fund. It gave him around 7-9% steady returns. 'It's like a Fixed Deposit' he said. 'But, much better. I don't have the headache of TDS. There's no penalty on premature withdrawal. And, after three years my tax liability is also much less (sometimes even nil). ' he added.

The second man bought an equity mutual fund. It gave him around 12-15% volatile returns. 'It's like an Equity Share' he said. 'But, much better. I don't have to spend time and efforts on research. I don't have to take buy/sell decisions. I don't have to closely monitor my investment. Even with little money, I get a diversified portfolio.' he added.

The third man bought a equity linked saving scheme. It gave him tax deduction. 'It's like an Sec 80C investment' he said. 'But, much better. The returns are likely to beat other investments specified u/s 80C. The lock-in of 3 years is minimum of all other options. The flexibility to continue, without lock-in after 3 years, helps in minimizing the equity risk.' he added.

The fourth man bought a gold fund. It gave him investment in paper gold. 'It's like buying gold' he said. 'But, much better. There is no risk of being sold impure gold by the jeweller. There is no risk of being sold gold at a higher price. There is no risk of theft. There is no problem of storage.' he added.

The fifth man bought a liquid fund. It gave him a place to park his money for a few weeks. 'It's like bank savings account' he said. 'But, much better. The returns are much more than 4% p.a. fixed for most bank saving accounts. It can be redeemed in just one day.' he added.

The sixth man bought a hybrid fund. It gave him part-safety of fixed deposits and part-superior returns of equity. 'It's like best of both the worlds' he said. 'But, much better. One investment takes care of both the needs. If I need more safety, I can go for conservative hybrid funds (called MIPs). If I need more returns, I can go for aggressive hybrid funds (called Balanced Funds).' he added.

The men argued. It's like a fixed deposit! No, it isn't! It's like a share! No it isn't! It's like a savings account! They did not agree. A financial mentor had been watching and listening to the men. 'You are not very clever. You only bought one type of mutual fund scheme. You did not check out the whole bouquet of schemes.' [Read: Investing in mutual funds is akin to eating at udipi restaurant.]

The men left the town still arguing.

MORAL OF THE STORY: Mutual Funds are the most misunderstood investment among most investors.

In this article I apply the same principle to investing in mutual funds.

First, a recap of the story…

Once upon a time there were six blind men. They lived in a town in India. They thought they were very clever. One day an elephant came into the town. The blind men did not know what an elephant looked like but they could smell it and they could hear it. 'What is this animal like?' they asked. Each man touched a different part of the elephant.The first man touched the elephant's body. It felt hard, big and wide. 'An elephant is like a wall' he said.

The second man touched one of the elephant's tusks. It felt smooth and hard and sharp. 'An elephant is like a spear' he said.

The third man touched the elephant's trunk. It felt long and thin and wiggly. 'An elephant is like a snake' he said.

The fourth man touched on of the legs. It felt thick and rough and hard and round. 'An elephant is like a tree' he said.

The fifth man touched one of the elephant's ears. It felt thin and it moved. 'An elephant is like a fan' he said.

The sixth man touched the elephant's tail. It felt long and thin and strong. 'An elephant is like a rope' he said.

The men argued. It's like a wall! No, it isn't! It's like a spear! No it isn't! It's like a snake! They did not agree. The king had been watching and listening to the men. 'You are not very clever. You only touched part of the elephant. You did not feel the whole animal. An elephant is not like a wall or a spear or a snake, or a tree or a fan or a rope'.

The men left the town still arguing.

(Story courtesy https://www.teachingenglish.org.uk/article/six-blind-men-elephant.)

|

| Mutual Funds are most misunderstood by most investors. |

Next, the modern twist to the same…

Once upon a time there were six ignorant investors. They lived in a town in India. They thought they were very clever. One day mutual funds came into the town. They did not know what kind of investment it was. 'What is this investment like?' they asked. Each man bought a different mutual fund.The first man bought a debt mutual fund. It gave him around 7-9% steady returns. 'It's like a Fixed Deposit' he said. 'But, much better. I don't have the headache of TDS. There's no penalty on premature withdrawal. And, after three years my tax liability is also much less (sometimes even nil). ' he added.

The second man bought an equity mutual fund. It gave him around 12-15% volatile returns. 'It's like an Equity Share' he said. 'But, much better. I don't have to spend time and efforts on research. I don't have to take buy/sell decisions. I don't have to closely monitor my investment. Even with little money, I get a diversified portfolio.' he added.

The third man bought a equity linked saving scheme. It gave him tax deduction. 'It's like an Sec 80C investment' he said. 'But, much better. The returns are likely to beat other investments specified u/s 80C. The lock-in of 3 years is minimum of all other options. The flexibility to continue, without lock-in after 3 years, helps in minimizing the equity risk.' he added.

The fourth man bought a gold fund. It gave him investment in paper gold. 'It's like buying gold' he said. 'But, much better. There is no risk of being sold impure gold by the jeweller. There is no risk of being sold gold at a higher price. There is no risk of theft. There is no problem of storage.' he added.

The fifth man bought a liquid fund. It gave him a place to park his money for a few weeks. 'It's like bank savings account' he said. 'But, much better. The returns are much more than 4% p.a. fixed for most bank saving accounts. It can be redeemed in just one day.' he added.

The sixth man bought a hybrid fund. It gave him part-safety of fixed deposits and part-superior returns of equity. 'It's like best of both the worlds' he said. 'But, much better. One investment takes care of both the needs. If I need more safety, I can go for conservative hybrid funds (called MIPs). If I need more returns, I can go for aggressive hybrid funds (called Balanced Funds).' he added.

The men argued. It's like a fixed deposit! No, it isn't! It's like a share! No it isn't! It's like a savings account! They did not agree. A financial mentor had been watching and listening to the men. 'You are not very clever. You only bought one type of mutual fund scheme. You did not check out the whole bouquet of schemes.' [Read: Investing in mutual funds is akin to eating at udipi restaurant.]

The men left the town still arguing.

MORAL OF THE STORY: Mutual Funds are the most misunderstood investment among most investors.