As a result of #demonetisation of Rs.500 and Rs.1000 currency notes in circulation till Nov 8, 2016, you were supposed to exchange or deposit such banknotes latest by Dec 30, 2016.

This is now being scrutinized by the Income Tax Department.

The idea is to identify cases of #blackmoney, where such cash transactions do not appear to be in line with the taxpayer's profile as per IT Dept.'s database. Such discrepancies need to be verified.

This verification — of demonetized currency deposited — has been termed as Operation Clean Money.

Relax!

You don't need to do any bulky paperwork. Nor do you have to visit the Income Tax Office.

If there is any mismatch between your cash deposits and your tax profile, you can verify the source of deposits ONLINE in a simple form... to show that it is not black money.

Briefly

- If your deposits have been identified as discrepant, you will receive an email and SMS.

- You can also view such information on https://incometaxindiaefiling.gov.in

- Log in (or register if not already registered)

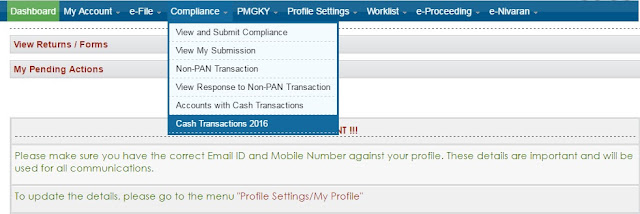

- Check the details at the link 'Cash Transactions 2016' under the 'Compliance' section

- If required, submit your explanation online (discussed below) within a period of 10 days

- That's it!

The case would be closed if the explanation, of the source of cash, is found to be clean and justified (or if you have declared the deposit as black money under Pradhan Mantri Garib Kalyan Yojna).

Key steps of this Online Verification of Demonetized Cash Deposits are discussed below.

Step 1.

Login on e-filing portal and click on 'Cash Transactions 2016' under the 'Compliance' section.

Step 2.

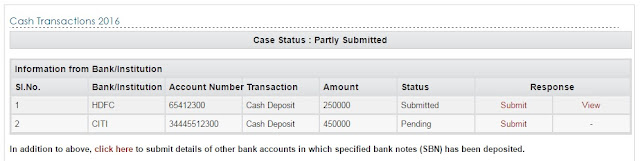

Details of cash deposits would be displayed ONLY IF they do not appear to be in line with the taxpayer's profile.

Step 3.

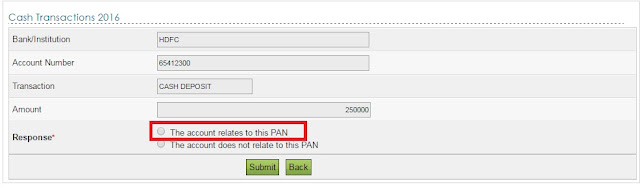

The next step is to confirm the bank account i.e. whether 'The account relates to this PAN' or 'The account does not relate to this PAN'.

Case 1 : If you confirm that 'The account does not relate to this PAN'

Following message will be displayed

"Your feedback will be sent to the information source for confirmation."

Click on the Submit button. Success message along with the Transaction ID would be displayed on the screen.

[Note: If the account relates to the PAN, but the amount is incorrect, you have to select the 'The account relates to this PAN' option. You can rectify the amount later.]

Case 2 : If you confirm that 'The account relates to this PAN'

You will be directed to the explanation section.

Step 4.

Under 'Explanation of Cash Deposit' transaction screen, there are two sections:

Section A : Account Details

The following details would be displayed

A.1 Bank / Institution : XXXXX XXXXXX Bank

A.2 Branch / IFSC Code : XXXXXXXXX

A.3 Account Number : NNNNNNNNNNNNNN

A.4 Cash Deposit in the account between 9th Nov 2016 and 30th Dec 2016 (as reported) : 23,00,000

A.5 Cash Deposit in the account between 9th Nov 2016 and 30th Dec 2016 (as confirmed) and Remarks : Here you either confirm the amount shown in A.4 or enter the correct deposit amount. Also give your comments, if any.

Section B : Source of Cash Deposit

There are 7 options available to disclose the source(s) of cash deposited by you.

B.1 Cash out of earlier income or savings + Remarks : Enter the amount and comments, if any

B.2 Cash out of receipts exempt from tax + Remarks : Enter the amount and comments, if any (e.g. agricultural income)

B.3 Cash withdrawn out of bank account : Provide the details viz. Bank, IFSC Code, Account No., Amount Withdrawn and Remarks

B.4 Cash received from identifiable persons (with PAN) : Provide PAN wise details viz. PAN of the person, Name of the Person, Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.5 Cash received from identifiable persons (without PAN) : Provide Person wise details viz. Name and Address of the Person, Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.6 Cash received from un-identifiable persons : Provide nature of transaction wise details viz. Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.7 Cash Disclosed / To be disclosed under PMGKY : Enter the amount you wish to be covered as black money under PMGKY Deposit and comments, if any

B.8 Balance (A.5 - B.1 - B.2 - B.3 - B.4 – B.5 – B.6 - B.7) : This would be automatically computed and should be ZERO i.e. the sum of all sources of deposit should match with the total amount deposited.

Once this is done, click on the Submit button.

Success message along with Transaction ID would be displayed as under:

Step 5.

You can view the details that you have furnished and even revise them, if required.

Click on the View button under respective bank account and then the Transaction number to view the details.

Click on the Submit button if you wish to revise the details furnished earlier.

Step 6.

In case you have made cash deposits, which are not reflected here, you need to disclose the same.

Click on the hyperlink below the list of bank accounts. Thereafter, again as per the above procedure, give details of the source of such deposits and validate the same. Success message along with Transaction ID would be displayed.

IMPORTANT POINTS TO REMEMBER

One. Verify and update your email address and mobile number on the e-filing portal (at https://incometaxindiaefiling.gov.in) so that you don't miss any communication from the Income Tax Department.

Two. If the cash deposited by you, is from more than one source (or out of cash in hand), you MUST assign the cash under various categories in the following sequence ONLY

a) Cash withdrawn out of bank account (Refer B.3)

b) Cash received from identifiable persons (with PAN) (Refer B.4)

c) Cash received from identifiable persons (without PAN) (Refer B.5)

d) Cash received from un-identifiable persons (Refer B.6)

e) Cash out of receipts exempt from tax (Refer B.2)

f) Cash out of earlier income or savings (Refer B.1)

g) Cash Disclosed/To be disclosed under PMGKY (Refer B.7)

A different sequence may result in your case being selected for further detailed verification.

Three. Information displayed on the e-filing portal is dynamic. It will be updated from time to time based on receipt of new information on black money, your response and data analytics on demonetized currency deposited.

[Note: If there are many entries under B.3 to B.6, you can also upload the data in CSV (Comma Separate Values) format specified in the User Guide.]

This is now being scrutinized by the Income Tax Department.

The idea is to identify cases of #blackmoney, where such cash transactions do not appear to be in line with the taxpayer's profile as per IT Dept.'s database. Such discrepancies need to be verified.

This verification — of demonetized currency deposited — has been termed as Operation Clean Money.

Relax!

You don't need to do any bulky paperwork. Nor do you have to visit the Income Tax Office.

If there is any mismatch between your cash deposits and your tax profile, you can verify the source of deposits ONLINE in a simple form... to show that it is not black money.

Briefly

- If your deposits have been identified as discrepant, you will receive an email and SMS.

- You can also view such information on https://incometaxindiaefiling.gov.in

- Log in (or register if not already registered)

- Check the details at the link 'Cash Transactions 2016' under the 'Compliance' section

- If required, submit your explanation online (discussed below) within a period of 10 days

- That's it!

The case would be closed if the explanation, of the source of cash, is found to be clean and justified (or if you have declared the deposit as black money under Pradhan Mantri Garib Kalyan Yojna).

Key steps of this Online Verification of Demonetized Cash Deposits are discussed below.

Step 1.

Login on e-filing portal and click on 'Cash Transactions 2016' under the 'Compliance' section.

Step 2.

Details of cash deposits would be displayed ONLY IF they do not appear to be in line with the taxpayer's profile.

Step 3.

The next step is to confirm the bank account i.e. whether 'The account relates to this PAN' or 'The account does not relate to this PAN'.

Case 1 : If you confirm that 'The account does not relate to this PAN'

Following message will be displayed

"Your feedback will be sent to the information source for confirmation."

Click on the Submit button. Success message along with the Transaction ID would be displayed on the screen.

[Note: If the account relates to the PAN, but the amount is incorrect, you have to select the 'The account relates to this PAN' option. You can rectify the amount later.]

Case 2 : If you confirm that 'The account relates to this PAN'

You will be directed to the explanation section.

|

Step 4.

Under 'Explanation of Cash Deposit' transaction screen, there are two sections:

Section A : Account Details

The following details would be displayed

A.1 Bank / Institution : XXXXX XXXXXX Bank

A.2 Branch / IFSC Code : XXXXXXXXX

A.3 Account Number : NNNNNNNNNNNNNN

A.4 Cash Deposit in the account between 9th Nov 2016 and 30th Dec 2016 (as reported) : 23,00,000

A.5 Cash Deposit in the account between 9th Nov 2016 and 30th Dec 2016 (as confirmed) and Remarks : Here you either confirm the amount shown in A.4 or enter the correct deposit amount. Also give your comments, if any.

Section B : Source of Cash Deposit

There are 7 options available to disclose the source(s) of cash deposited by you.

B.1 Cash out of earlier income or savings + Remarks : Enter the amount and comments, if any

B.2 Cash out of receipts exempt from tax + Remarks : Enter the amount and comments, if any (e.g. agricultural income)

B.3 Cash withdrawn out of bank account : Provide the details viz. Bank, IFSC Code, Account No., Amount Withdrawn and Remarks

B.4 Cash received from identifiable persons (with PAN) : Provide PAN wise details viz. PAN of the person, Name of the Person, Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.5 Cash received from identifiable persons (without PAN) : Provide Person wise details viz. Name and Address of the Person, Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.6 Cash received from un-identifiable persons : Provide nature of transaction wise details viz. Nature of Transaction, Amount Received and Remarks [e.g. donation, gift, loan, cash sales]

B.7 Cash Disclosed / To be disclosed under PMGKY : Enter the amount you wish to be covered as black money under PMGKY Deposit and comments, if any

B.8 Balance (A.5 - B.1 - B.2 - B.3 - B.4 – B.5 – B.6 - B.7) : This would be automatically computed and should be ZERO i.e. the sum of all sources of deposit should match with the total amount deposited.

Once this is done, click on the Submit button.

Success message along with Transaction ID would be displayed as under:

Step 5.

You can view the details that you have furnished and even revise them, if required.

Click on the View button under respective bank account and then the Transaction number to view the details.

Click on the Submit button if you wish to revise the details furnished earlier.

Step 6.

In case you have made cash deposits, which are not reflected here, you need to disclose the same.

Click on the hyperlink below the list of bank accounts. Thereafter, again as per the above procedure, give details of the source of such deposits and validate the same. Success message along with Transaction ID would be displayed.

IMPORTANT POINTS TO REMEMBER

One. Verify and update your email address and mobile number on the e-filing portal (at https://incometaxindiaefiling.gov.in) so that you don't miss any communication from the Income Tax Department.

Two. If the cash deposited by you, is from more than one source (or out of cash in hand), you MUST assign the cash under various categories in the following sequence ONLY

a) Cash withdrawn out of bank account (Refer B.3)

b) Cash received from identifiable persons (with PAN) (Refer B.4)

c) Cash received from identifiable persons (without PAN) (Refer B.5)

d) Cash received from un-identifiable persons (Refer B.6)

e) Cash out of receipts exempt from tax (Refer B.2)

f) Cash out of earlier income or savings (Refer B.1)

g) Cash Disclosed/To be disclosed under PMGKY (Refer B.7)

A different sequence may result in your case being selected for further detailed verification.

Three. Information displayed on the e-filing portal is dynamic. It will be updated from time to time based on receipt of new information on black money, your response and data analytics on demonetized currency deposited.

[Note: If there are many entries under B.3 to B.6, you can also upload the data in CSV (Comma Separate Values) format specified in the User Guide.]